INDIGENOUS BUSINESS AUSTRALIA

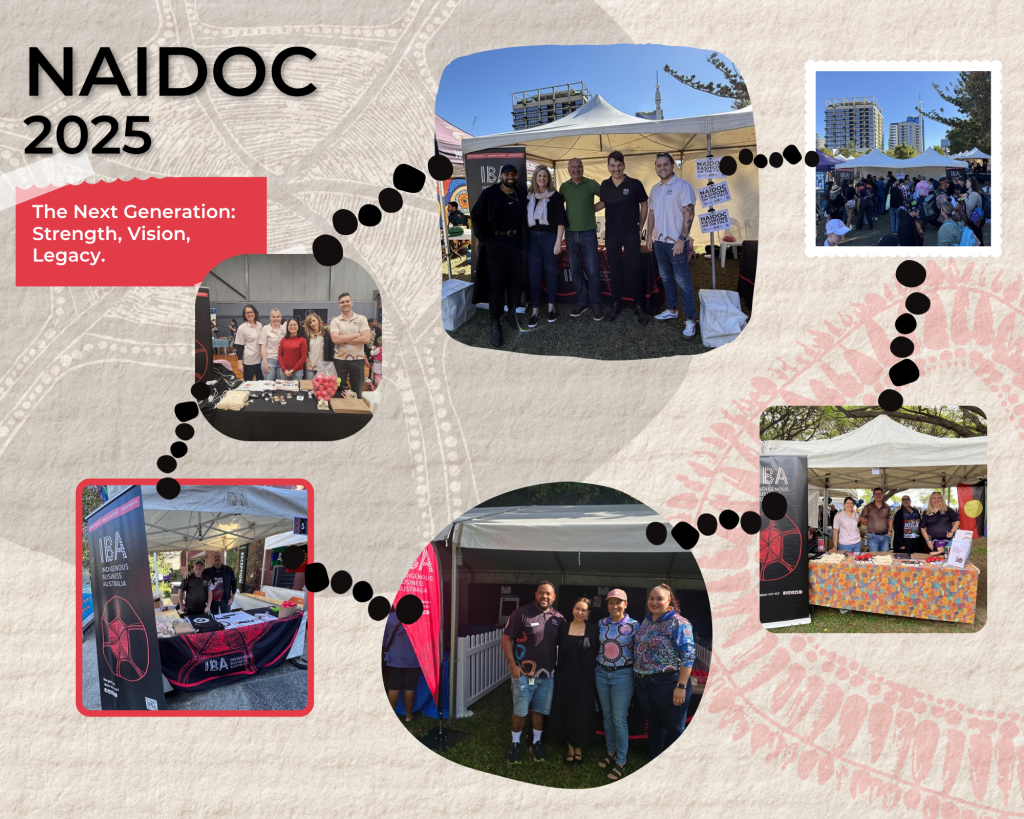

As NAIDOC Week 2025 marked its 50th anniversary, IBA proudly stood alongside communities across the country to celebrate the enduring culture, strength, and leadership of Aboriginal and Torres Strait Islander people. This year’s theme, “The Next Generation: Strength, Vision & Legacy,” honours the wisdom of Elders while spotlighting the empowering voices of Aboriginal and Torres Strait Islander youth. From storytelling and cultural performances to live music and ceremony, events nationwide fostered pride, unity, and connection uplifting the next generation and showcasing their leadership.

Highlights of the week included:

While NAIDOC Week has wrapped, the celebration of Aboriginal and Torres Strait Islander culture, resilience, and leadership continues every day. IBA is proud to walk alongside First Nations people, our customers, stakeholders, and the Galambany network.

Always was, always will be.

“Through the Generations” One Legacy. Many Futures. Your stories. Our history. 50 years through the Generations.

Through the generations, we’ve had the privilege of supporting First Nations families and communities in supporting their dreams. From parents and individuals building a foundation of home ownership, to entrepreneurs growing businesses that thrive, each step forward has been driven by the determination and vision of Aboriginal and Torres Strait Islander peoples. Together, we’ve turned aspirations into legacies that continue to inspire future generations.

To share IBA’s 50-year milestone we thought it was the perfect time to share this with all of you. Our theme is Through the Generations which represents generational excellence, success and impact of Aboriginal and Torres Strait Islander peoples and communities.

The animation video is not only a representation of IBA, who we are, what we do and the impact but to tell a story. Story and storytelling are fundamental within our community it is a powerful exchange of connection. Stories carry deep wisdom, history, identity and spiritual significance. The animation draws on oral storytelling with the use of a voiceover done by Malinda director of Blkfsch to encompass our history and ways of knowing and being.

The video symbolises different parts of culture with two main focal points of the animation video to demonstrate that. Matriarchs are the backbone of Aboriginal and Torres Strait Islander communities. They are at the centre of everything we do with their influence extending to raising families and communities, healers, keepers of culture and knowledge and storytellers. They reflect where we came from and encourage us to go beyond. That is why it was essential to have an Aunty as the focal point of the video.

Another focal point of the video is the Grandmother tree, which holds deep spiritual and cultural significance to Aboriginal and Torres Strait Islander peoples. They are often known and serve as gathering places for learning, teaching and connection to land, representing the link between past, present and future generations. Trees have different meanings depending on the Country you are living on, but Grandmother trees are symbol of strength, resilience and connection.

For thousands of years Aboriginal and Torres Strait Islander history, lore and stories have been communicated and shared through oral storytelling. It is an important foundation to how we learn and connect with each other.

Share this journey with us and hear the story of IBA and the amazing milestones of Aboriginal and Torres Strait Islander people and communities in the 50 years of IBA.

Watch the video here: Reflecting on 50 years "Through the Generations"

As IBA proudly recognises its 50th anniversary this year, another significant milestone stands alongside it, the 25th anniversary of Bawrunga Aboriginal Medical Service (BAMS). These shared anniversaries are more than numbers; they are a reflection of generations of resilience, partnership, and unwavering dedication to uplifting First Nations communities.

As one of the original founders, Weilwan woman Leavina Reid helped establish BAMS in 1999 to reduce the barriers Indigenous communities faced in accessing culturally appropriate GP clinic services. Leavina herself experienced firsthand the difficulty of accessing healthcare for her and her then 3-year-old daughter when they needed medical treatment.

At the local practice in the Nambucca Valley, the doctor asked Leavina, “Who do you want to be bulk billed, yourself or your daughter? I can only bulk bill one.” Without hesitation, she chose her child. She went without care that day, but the experience left her feeling humiliated and deeply hurt.

Mother’s love sparked a movement

That moment became a turning point. It pushed her to ensure no other Aboriginal person would be made to feel that way again and shamed in the same way. It was a mother’s love that sparked a movement, one that would grow into a legacy of care, dignity, and empowerment for generations to come.

Fast forward 25 years, and BAMS has transformed into one of the largest Aboriginal community-controlled social enterprises in NSW, operating multiple GP primary health clinics. Its journey is marked by groundbreaking achievements, including securing the Commonwealth Government tender in 2011 to build and operate the Coffs Harbour GP Super Clinic which has now been sold to a group of doctors, including a long-serving GP with deep ties to the clinic. This thoughtful transition ensures the clinic’s continued success and sustainability, while honouring the legacy of care established over the past decade.

Reflecting on this milestone, Leavina shares, “Our work is about more than just healthcare; it’s about making a difference in the lives of our people, ensuring they feel seen, heard, and cared for... Our journey is a powerful testament to what can be achieved when we work and move as one.”

Strategic expansion as 2nd chapter

This strategic move allows BAMS to focus on the 2nd chapter of its mission, BAMS Impact. This initiative expands beyond clinical care to address broader social determinants of health, including education, housing, and employment. With a foundation built on 25 years of expertise and deep community engagement, BAMS Impact is set to collaborate with key stakeholders with the aim of solving the various social issues faced by Indigenous communities, improving both clinical and social wellbeing thereby closing the gap in Indigenous health and wellbeing.

One of its first projects involves a partnership with a prominent Sydney law firm to provide pro bono culturally appropriate legal services at BAMS medical centres. Other initiatives in progress include establishing scholarship funds with the Australian Community Foundation and launching Indigenous Community Green Energy Projects to create sustainable job opportunities and strengthen rural infrastructure.

Supporters in progress

From humble beginnings to a thriving network of clinics, BAMS has become a beacon of Indigenous led healthcare innovation. Throughout this journey, IBA has supported them with business support and finance lending.

Deputy CEO, Sean Armistead, says: “Being part of BAMS’ journey has been a privilege. Their incredible growth and unwavering commitment to the health and wellbeing of First Nations communities are a testament to the strength of grassroots initiatives. We are proud to have walked alongside them.”

Throughout BAMS’ journey, many have played instrumental roles in its success. Leavina highlighted Dr. Larry Yee, whose support has been invaluable from the early days of the first Bowraville clinic in 1999 to the successful tender for the Coffs Harbour GP Super Clinic in 2011. His belief in BAMS’ mission and his contributions to its growth have helped shape its evolution.

As BAMS Impact prepares for its new journey, Dr. Yee shares his excitement “The timing is perfect, it’s as if the universe has aligned in our favour. BAMS Impact is poised to lead a transformative revolution in Indigenous healthcare, setting new standards for impact, success, and future potential.”

As IBA celebrates 5 decades of supporting First Nations businesses and communities, BAMS stands as a testament to the extraordinary achievements made possible by grassroots initiatives and strategic partnerships. Its journey from a single clinic to a network of thriving healthcare facilities embodies the power of determination and collaboration in turning aspirations into lasting legacies.

Leavina captures the essence of BAMS' story: “We’ve come so far because we believed in a vision larger than ourselves. And now, with BAMS Impact, we’re taking that vision to a whole new level.”

Rooted in the strength of the past and driven by the purpose of today, together IBA and BAMS are creating a future where every generation is empowered to live well, lead with confidence, and shape their own story.

Samuel is a proud Butchulla man, a land conservationist, a devoted father, and now, a homeowner.

As a single-carer, Samuel’s journey to home ownership is a powerful story of determination and a desire to build a life for him and his son.

“I feel blessed being a homeowner. I feel like it’s a great accomplishment - having my own space with my son. It makes me feel very proud” he said.

The path to home ownership wasn’t easy, especially while juggling work, parenting, and financial responsibilities.

“It’s hard being a single parent, prioritising and budgeting, just the simple stuff. You’ve got to make sure you’re covered. That’s the main thing.”

Finding support through IBA

Samuel first heard about IBA’s home ownership program through his community.

“They said there was an information session, so I just went along to find out the process and to ask any questions.”

From that first session, Samuel found not just information, but ongoing support. IBA’s team guided him through the application process, offering help at every step.

“Just make the phone call, someone will get onto you and show you how to go through the application. It was good because they kept helping me along the way” he said.

1 in 5 IBA home loan customers are single-carers, and like Samuel, are navigating the home loan journey on their own. IBA supports single-carers with tailored support, flexible loans, and culturally grounded guidance.

Samuel’s story is proof that, “you can do anything if you’ve got the drive and the passion.”

Words of wisdom

Samuel’s message to others in his community is simple but powerful:

“My people, stay positive and keep focused. You can do anything in this life, if you’ve got the drive and the passion.”

His story is a reminder that homeownership isn’t just about a roof over your head, it is about belonging, stability, and legacy. For Samuel, it’s also about raising his son in a space that’s truly their own, while continuing to care for the land that sustains them both.

Did you know?

IBA offers free online and face-to-face home ownership information sessions. We also offer tailored sessions to meet your needs. Reach out to arrange an information session or register for one of our online information sessions here. All IBA products are subject to relevant terms and conditions.

Welcome to “The New Dreaming Podcast”, a powerful platform created to celebrate strength, success, and storytelling among Aboriginal and Torres Strait Islander men.

Born from a partnership between IBA and New Dream Productions, this special series holds space for truth-telling and real conversations that inspire, challenge, and empower. Each episode features First Nations men who are reshaping their futures, sharing journeys of resilience, leadership, and cultural pride in a space that honours their voices.

From stories of overcoming adversity to reflections on identity and purpose, the series invites listeners into conversations that are honest, uplifting, and deeply grounded in lived experience.

It’s a space where voices are heard, stories are honoured, and futures are imagined—together.

From his early days in Bowen dreaming by the shoreline to launching a coffee window beside his sister’s clinic, Josh’s journey is one of creativity, resilience, and purpose. Drawing on his background in Indigenous health and HR, he’s built a business that prioritises staff wellbeing and customer connection, challenging industry norms with professional practices and a family-first culture.

With plans to expand into deli-style offerings and a wine bar, Josh continues to grow his impact while staying true to his artistic roots in music. His story is a testament to trusting your instincts, building with intention, and creating spaces where people feel truly seen.

With no formal business training or entrepreneurial background, Jordan followed his instincts, diving into podcasts, audiobooks, and industry research to carve his own path. Support from IBA played a pivotal role, helping him turn ambition into action with practical guidance and funding.

Jordan speaks candidly about the realities of burnout and the importance of balance, offering hard-earned wisdom for anyone considering a leap into business. His story is a powerful reminder that trusting your gut and taking the first step can lead to a life of purpose and growth.

Raised in Logan as one of nine siblings, James draws strength from his Gunditjmara and Wiradjuri roots, which now shape the heart of his digital marketing business. After years of watching his cultural knowledge benefit others, he launched Barragi Mawang to empower Indigenous businesses with digital tools while staying true to community values.

With support from IBA, James has built a platform that blends business with storytelling—producing documentaries like Yurlu Country and writing about his uncle, the first Indigenous person commissioned in the Australian Army. His journey is a reminder that success doesn’t have to mean speeding up—it can mean slowing down to honour culture, connection, and authenticity.

In this candid episode, Adam explains how starting with social media before moving into e-commerce has helped First Nations businesses grow at the right pace. His story highlights the importance of relationships, especially with support organisations like IBA, and shows how real-world connections are just as vital as digital tools.

With new initiatives like the POS Cafe Shopify app and tailored programs for service-based businesses, Adam and his partner Carmel are creating meaningful change while staying grounded in culture and community.

Taunurung woman, Nicole, is a successful business and homeowner, with a lot to be proud of. But she takes the greatest pride in the values and financial independence that she inspires through generations of her family.

Nicole was determined from a young age to get on the property ladder early, to build her financial future. She achieved this at just 19 years old, through a loan with ATSIC (which later became IBA) and bought the ex-housing commission home that she’d grown up in.

“It was small, but over the years I made improvements to it,” Nicole said. “Funny thing is – I always understood the value of owning a home. I didn’t want to pay rent and waste money that could go into my own home.”

In time, Nicole transitioned to a mainstream lender and moved to another home. Fast-forward almost 40 years and one of Nicole’s three daughters, Georgia, has recently been approved for her first IBA home loan.

“I told Georgia about IBA and the value in saving to get her own place,” Nicole said. “I wanted her to have her own place too, not to waste money on rent.”

“It’s hard work and a lot of paperwork, but worth it. She’ll have her own home.”

“If Georgia had to go down a regular path, it’d be years before she had enough saved for a 20% deposit on a house. So, I kept saying to her, ‘make the enquiry at IBA’.”

Georgia and her partner, Mackenzie, have just found a home of their own with a backyard to share with their adored animals – she is the owner of three cats and wants to add to the brood with chickens and a dog.

“Sticking our sold sign onto the sale board was an amazing feeling!” Georgia said.

“I grew up with mum always having a home, and she inspired me to want the same.”

“I did rent for a while and it’s hard to save and have security when renting. I could see that the money I was paying in rent could be going into a place of my own.”

“So, I moved back to Mum’s for twelve months to squirrel my money into savings.”

While Georgia was looking for her home, Nicole was with her every step of the way and helping her go through building reports, paperwork and giving her advice on her home purchase.

“Mum has made me very aware of what I’m getting into!” Georgia laughed.

Nicole also owns and runs a successful business, Gerrbik Laundry Services. She bought it from her dad (then known as Complete Workwear Laundry Services) with an IBA business loan in 2015. We met her back then to yarn about her business journey: Poised for success - Indigenous Business Australia.

While Nicole’s business is flying now, she has faced huge challenges. Her core business is servicing the airline industry, and she says COVID-19 restrictions wiped out 95% of her business overnight. Nicole says that at times she thought she might lose her business, and her house (which had been used as collateral for the business). But managed to keep going and weather the storm.

"My connection with IBA has been a lifeline to me!" said Nicole. "They believed in me which has given me a lot more belief in myself."

Her hard work and tenacity paid off and the business revenue has since tripled from pre-Covid including a 7-year contract with an airline for their laundry service. Nicole credits the business success to her amazing team which includes three generations of family working with her, something that she is very proud of.

Georgia has also inherited her mum’s strong work ethic. She is a professional baker and part of a boutique artisan bakery, working early hours and long days. She’s not afraid of hard work.

Nicole’s impact through the generations doesn’t stop there. She’s also encouraging one of her other daughters to start preparing to apply for an IBA loan and saving for a deposit.

“It’s about sustaining yourselves through life.” Nicole said. “We need to be self-sustainable. I want to pass that on to my kids and grandkids.”

“My nine-year-old grandson already wants a house too,” she continued. “He even saved his birthday money. That’s exciting - knowing it’s passed down. That will be a legacy for our family.”

~~~~~~~~~~~~~~~~~~

Nicole spoke at IBA’s release of our latest impact report on 29 May on Gadigal Country. She discussed the generational impact of financial wellness. Check out IBA’s impact reports here: IBA Impact Report 2024 - Indigenous Business Australia

Desiree and her two younger sisters enjoyed sitting down for a yarn about life and what ‘financial wellbeing’ means to them. IBA recently hosted a workshop at Kurbingui Youth & Family Development to support the community on their financial goals.

Kurbingui is an Aboriginal community-based and driven not-for-profit organisation that offers services to Aboriginal and Torres Strait Islander community members, families, children, and young people living within the Greater Brisbane, Moreton Bay, and Southeast Regions.

IBA’s home ownership guru, and Senior Business Development Manager, Jenny Pepper hosted the workshop and was touched by the group’s interest in the content discussed.

"This is the second session I've facilitated with new trainees at Kurbingui. Dani and the team recognise the importance of setting these young people up for success as they start in the workforce. One young man told me, 'Thanks for coming today. I might not have looked like I was listening, but I was. The things you talked about really opened my mind up.' Hearing this was music to my ears and absolutely filled my cup," said Jenny.

The financial decisions you make today can have a lasting impact, so getting the tools and information early helps to make informed decisions for the future. It’s all about implementing good habits now – and that’s what IBA shares through our ‘Financial Wellbeing’ workshops.

Desiree came to the workshops along with her two younger sisters to see what it was all about. She said, "The workshop was incredibly eye-opening. It made us really think about our spending habits and how we can manage our money better.”

“One thing I learned is that if you're constantly dipping into your savings, you're not really saving. So, I've decided to create separate bank accounts to avoid that temptation," said Desiree - one of her key take aways from the workshop.

Desiree also talked about how the workshop is helping her on her journey to home ownership.

"It's already made a big difference. I'm trying to teach these principles to my younger sisters. It's all about making sacrifices now for a better future" she said.

Being at the workshop with her sisters was a special experience for Desiree.

"It felt really good to be there as a family. We can now support and encourage each other to make better financial decisions. It's opened our eyes to how much we actually spend and how we can save more effectively."

Desiree's motivation to pursue home ownership reflects the positive trends highlighted in our Pathways through Housing report. The report shows that the number of First Nations households owning homes has more than tripled from 46,150 in 2001 to 145,100 in 2021.

This growth reflects a strong desire for self-determination and the benefits of home ownership, such as security, wealth building, and freedom of choice. Desiree's journey is a testament to these positive trends, showing how financial education and support can pave the way for successful home ownership.

As we look to the future, Desiree's words resonate with IBA’s mission, "it's about making sacrifices now for a better future" she said. This sentiment perfectly aligns with the 50th anniversay of IBA's Indigenous Home Ownership Program.

Our theme, "50 Years: Through the Generations," embodies the resilience, wisdom, and courage of past generations while celebrating the innova tion and passion of the present.

IBA’s 50th anniversary emblem embodies connection, progress, and community. The 5 and 0 are formed from the elements of the IBA brand and feature the shapes within the IBA logo. These lines and circles signify the pathways, and the milestones accomplished alongside our customers. The design honours our shared journey and achievements through the generations.

Desiree's journey and the experiences shared in our workshops are a testament to the power of community and the importance of financial education. Together, we are building a brighter future for all generations.

Join us as we continue to empower our community with the knowledge and tools to achieve financial wellbeing and home ownership.

Find out more about IBA’s free home ownership info sessions and financial wellbeing workshops.

Did you know that we also have Business Skills workshops? Find out more here.

About Tim

I consider myself a self-proclaimed professional fisherman. I have caught everything from tuna, salmon, sharks, and one-time, a 30m humpback whale (yes, I let it go). The most interesting part of fishing is, ‘I don’t eat fish.’

Growing up I lived in places like Camperdown to Newtown to Tathra to Bega (all NSW) to growing up in a quiet country town in ACT. I am both a Yuin and Gadigal man with Fijian and Indian ancestry.

Apart from always finding me at Tathra wharf trying my luck fishing, I love all things rugby (League & Union, GO MANLY), cricket, abseiling, canoeing, kayaking and being a part-time superhero.

What is your role at IBA?

I am a Senior Securities & Settlements Officer in the Business Solutions program. My role includes a number of tasks which is not limited to drafting and issuing loans, security documentation, facilitating release of funds to customers, vendors, settlement agents, and assisting other teams on enquiries regarding securities and settlements matters, processes, and requirements.

Highlight at IBA/career

Through my time at IBA, I never aspired to be a director, CEO or chairman. I always just wanted to do something that I enjoyed. With IBA, I was able to understand and see first-hand the way we directly assist mob, not only individuals but also organisations, in realising their dreams in owning their own home, business, and assisting their own communities.

I have been with IBA now for 20 years since the abolishment of ATSIC in 2005. Overall, I have been attached to the home and business loan programs for nearly 26 years since June 1999 (6 years ATSIC Legal Unit, 6 years with IBA Housing Solutions, then 14 years with IBA Business Solutions since 2011).

Why IBA

Working with and for mob is highly important as only mob can help mob. From my personal experience having lived predominately in an urban area such as the ACT (including foster care for a long period), I had not been exposed a lot to my own culture (both Fijian and Aboriginal), so being with, working with and for, anyone from your own cultural background is very important.

What does 50 years mean to you?

Being able to assist Aboriginal and Torres Strait Islander people in achieving their goals in both home and business ownership for 50 years has been a great achievement for the programs that have continually evolved to meet the needs of our customers. IBA has changed in many ways over the years, but even through the changes and evolving, IBA remains its own unique self.

I am a proud Yuin woman with family connections to Dharrawal Nation and the La Perouse community. I was born in Nowra NSW (2 hrs south of Sydney) and grew up in my community, the old Roseby Park (Jerringa) mission in Culburra, up till I was 10 years old. Growing up on Country and in my community connected me to my culture and identity. I was surrounded by all my cousins, Nan, Pop, aunties, uncles, Mum and my stepdad. Family has always been such a huge influence on me growing up.

It was hard for my family to find jobs and to provide the life that we deserved, which led us to move. We relocated to Queensland which was a cultural shift since I was used to being around community and immersed with culture. I faced identity challenges as I didn’t fit the “stereotype” Aboriginal person. However, I was able to overcome that adversity and maintain my cultural connection through my mum and aunties. This has a profound impact on the person I am today.

I now reside with my partner and son on beautiful Kabi Kabi land (the Sunshine Coast) which fills my cup as it so close to the ocean. As a saltwater woman I live and breathe the beach which always makes me feel like home. In my free time and anytime outside of my mummy duties, I’m at the beach.

I am the Community Experience Officer within IBA’s Community & Customer Experience team (CCE). My role includes reviewing some of IBA’s initiatives, projects, products and processes to ensure we have our customer experience at the centre. This includes handling customer complaints and providing various project supports, giving our customers not only the best customer service, but the best customer experience.

It's an interesting space to work in but it’s also an important one. We are here to serve a specific client set. Our customers’ journey with IBA should be culturally appropriate and supportive at all points of interaction with us.

I started my career journey working in various admin roles. I worked in industries such as insurance which focus on profit rather than people which didn’t sit with my value set. It made me realise that I wanted to do something where I have that connection and passion, especially working with mob. So, if I can make even a small difference for my mob and assist with community development, that’s success for me.

I started working at IBA in 2017 as a Business Support Officer then moved to the Special Projects team where I worked on projects such as Women in Business and the Accelerator program. I left IBA in April 2021 to begin studying a Bachelor of Social Science full-time. The social impact of the work really cemented my passion in working in this space.

When I saw the opportunity of the Customer Experience Officer within CCE come up, I knew I wanted to stay at IBA so I applied and have been working here ever since.

I see IBA as having an important job to do for Aboriginal and Torres Strait Islander people and the wellbeing of community.

The work we do improves the inequality faced by Indigenous Australians. Engaging customers and centring our projects and programs around mob ways of doing and being, is a powerful way of driving that change.

A lot of mob have a mistrust towards government. It’s important to build that trust and fill those gaps. There are so many opportunities to help our mob, and I wanted to be part of an organisation that has that potential. It also aligns with my personal values and wanting to see mob do well. I want to be able to influence that any way I can.

Every holiday season between November to December it’s everything Christmas. From movies such as Home Alone, Elf, The Holiday to cheesy Netflix Christmas Movies like The Knight Before Christmas and The Holiday Calendar; I love them all. Much to my partners dismay, that is 😉

We recently launched our Pathways Through Business report at an online event hosted by IBA’s Dr Siddharth Shirodkar, Principal Economist, who was joined by two First Nations business owners who shared their inspiring and groundbreaking stories – Shane Kennelly, Managing Director of Kennelly Constructions, and Hanina Rind, Founder of Yarn Legal. Both shared experiences that highlighted the strength, resilience, and powerful potential within the Indigenous business community.

The findings from the Pathways Through Business report show us the transformative growth in the sector: the Aboriginal and Torres Strait Islander business sector grew by over 50% from 2016 to 2021, reaching approximately 29,200 business owners—or 4.4% of the population aged 15 and above. This phenomenal rise in First Nations business owners speaks volumes about the resilience and dedication of mature First Nations businesses that have long overcome barriers and challenged stereotypes.

Shane Kennelly, a proud Bundjalung man, has turned his construction company, which has been operating for over a decade, into a symbol of success for Indigenous business in Australia.

A lot has changed over that time, not least of which is the success of the Indigenous Procurement Policy. “Up until 2015, being known as a black business was a disadvantage because of cognitive or behavioural discrimination in procurement. But the Indigenous Procurement Policy changed things, making big companies accountable for engaging Indigenous suppliers. We’ve seen massive growth in the sector, but there’s still a lot of work to be done.”

Reflecting on his journey, he said, “[Business] people give us the opportunity because we will not let you down. There’s a stigma that black businesses can’t succeed…we [First Nations entrepreneurs] take that load personally, to make it an easier pathway for others in the future.”

Shane’s dedication isn’t just about building a thriving business; it’s about creating a legacy and setting a foundation for the next generation. “Our goal is not just about growing a business. It’s about creating a path for our children and future generations. The opportunity to own a business wasn’t afforded to my family or generations before that, so for me, it’s about creating a legacy and being a role model.”

For Shane, the real challenge was competing in a mainstream market without the advantage of intergenerational wealth—a reality for many Indigenous entrepreneurs. Fortunately, for programs like IBA’s, it made a crucial difference, giving Kennelly Constructions the leverage to expand and take on larger contracts. Shane’s story is a testament to the power of tailored support and the dedication of Indigenous business owners to creating a legacy.

For Hanina Rind, the journey into business began with the courage to take a risk. As the founder of Yarn Legal and a proud Yamatji, Badimaya, and Balouchi Muslim woman, Hanina built a culturally safe and trauma-informed legal practice. Her decision to establish her own practice was driven by a passion for empowering her community and creating a space for other Indigenous women.

“For many Indigenous women, it’s not just financial support that’s needed—it’s that cultural support, that sense of validation and encouragement from others. We’re often balancing so many roles and responsibilities, so knowing someone believes in you is powerful.” Hanina shared.

Aboriginal and Torres Strait Islander women are the fastest growing business demographic in Australia. First Nations women represented 36% of the business sector in 2021, up from 33% in 2016, in part due to initiatives like IBA’s Strong Women Strong Business. However, they currently make up only 31% of IBA business loan customers. This is something IBA is looking to address, so that more First Nations women feel comfortable taking on suitable finance products, so watch this space.

Hanina spoke passionately about the challenges Indigenous women face, balancing cultural responsibilities, community needs, and the demands of business. “For me, it was about finding that balance between community support, financial backing, and the courage to take that step forward.”

Her journey exemplifies how community backing, and belief can fuel business success, particularly for women carrying cultural and familial responsibilities.

“Taking the leap, taking the risk… that’s the part we often hesitate on, but that’s what opens doors.” she said, encouraging other Indigenous women to pursue their dreams, knowing they have the strength and resilience to overcome barriers.

Both Shane and Hanina’s stories remind us that while policy, like the Indigenous Procurement Policy, plays an essential role in leveling the playing field, it’s the personal drive, courage, and community support that truly propel Indigenous entrepreneurs forward.

These entrepreneurs are paving a path for future generations, breaking down barriers, and rewriting what Indigenous success looks like in Australia’s business landscape.

The hard work of Aboriginal and Torres Strait Islander business owners has truly blazed the trail, making business ownership a more genuine and accessible path for the next generation of First Nations entrepreneurs. Together, they’re proving that with courage, support, and the right resources, Indigenous business can continue to drive self-determination and economic empowerment—one success story at a time.

For more information: