Completing a Joint Expression of interest (EOI)

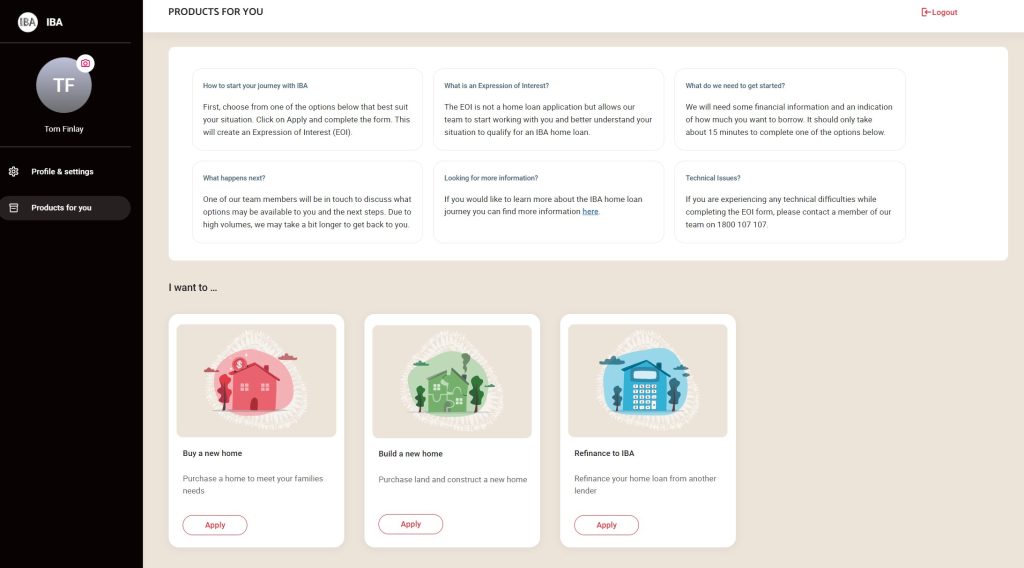

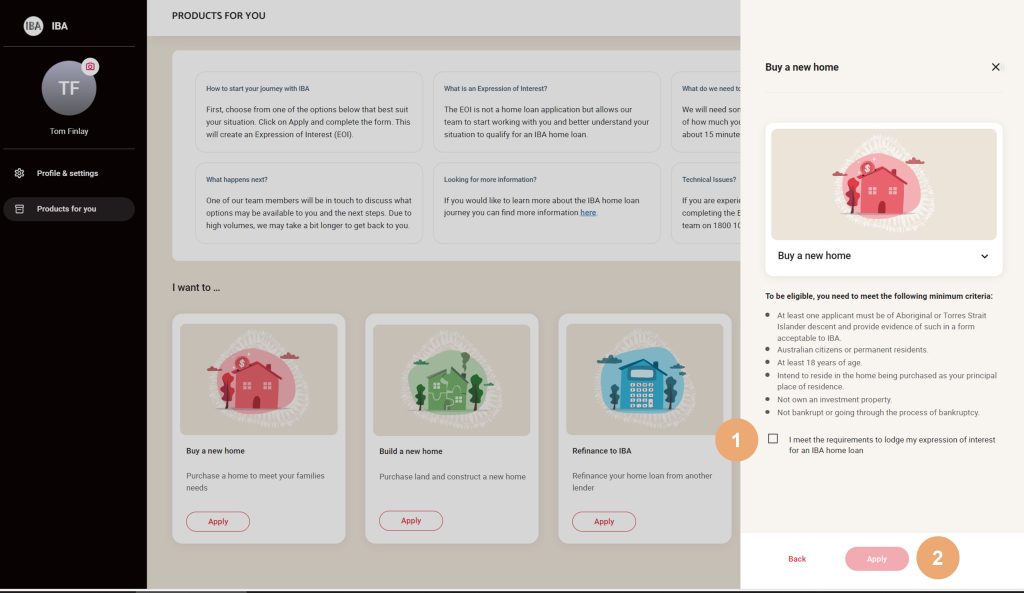

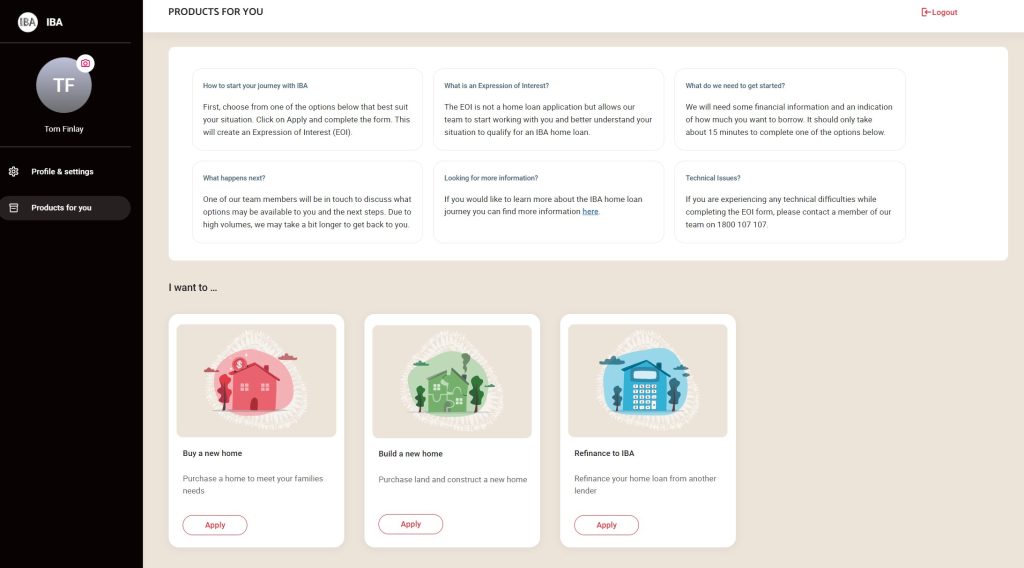

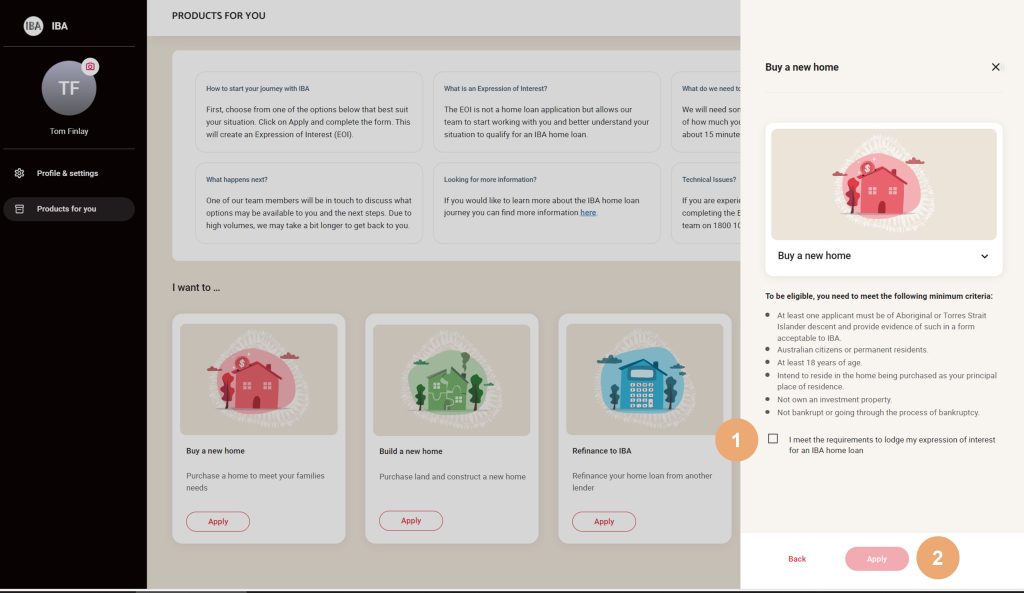

Product Selection

From the products page, select your preferred home loan product.

- Select to confirm meeting the home loan eligibility criteria

- Select Apply

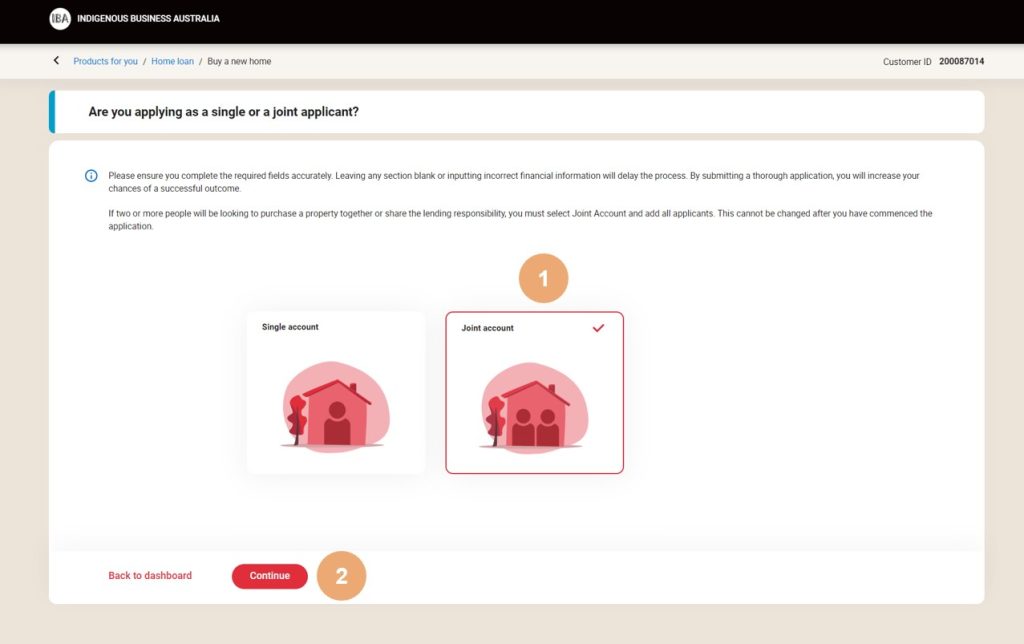

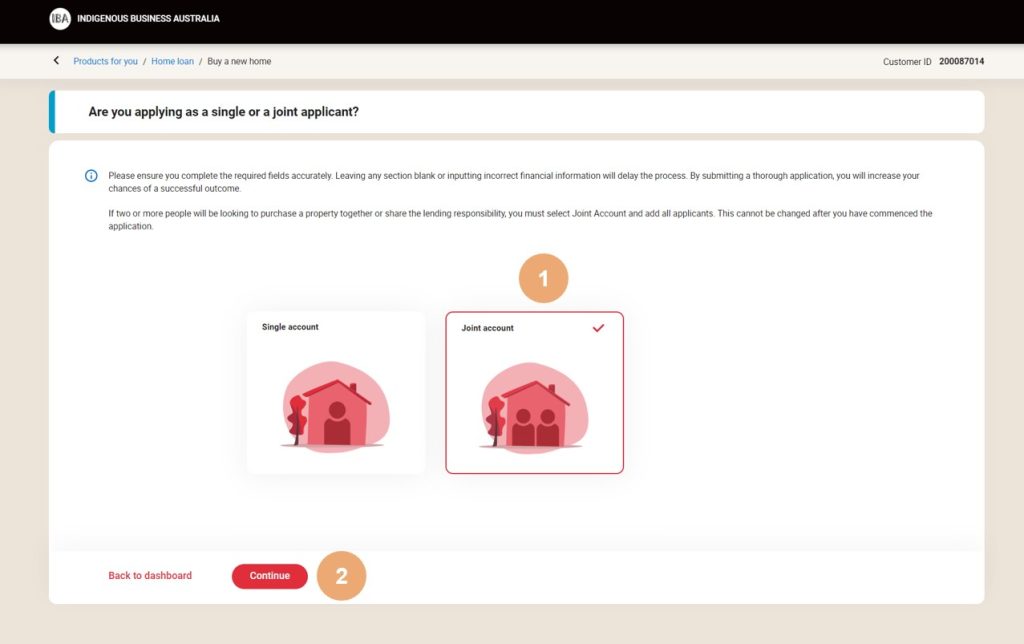

Screen Name: Are you applying as a single or a joint applicant?

1. Select joint account

2. Select Continue

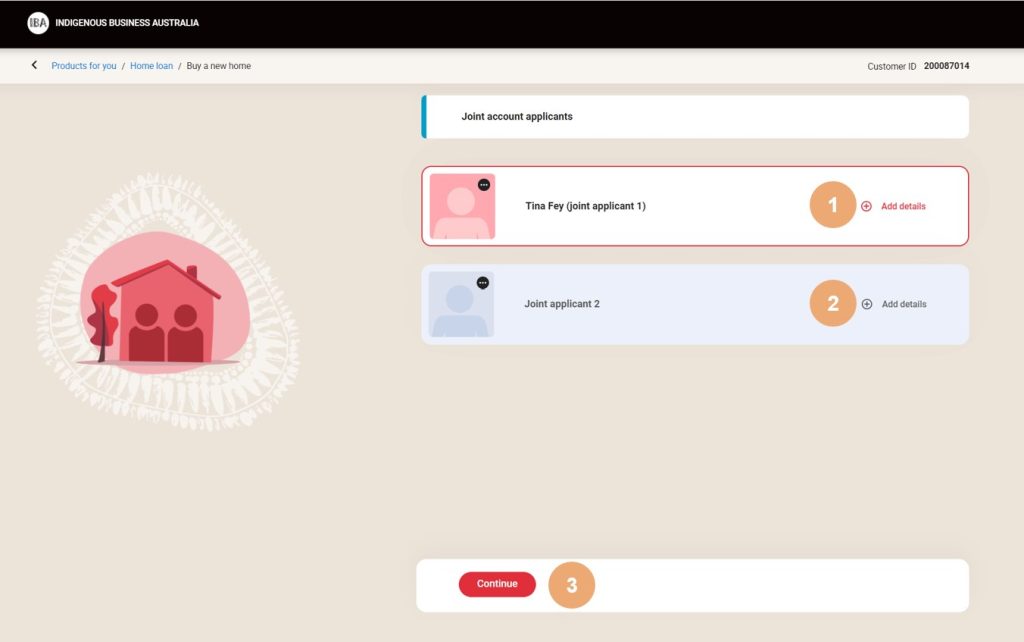

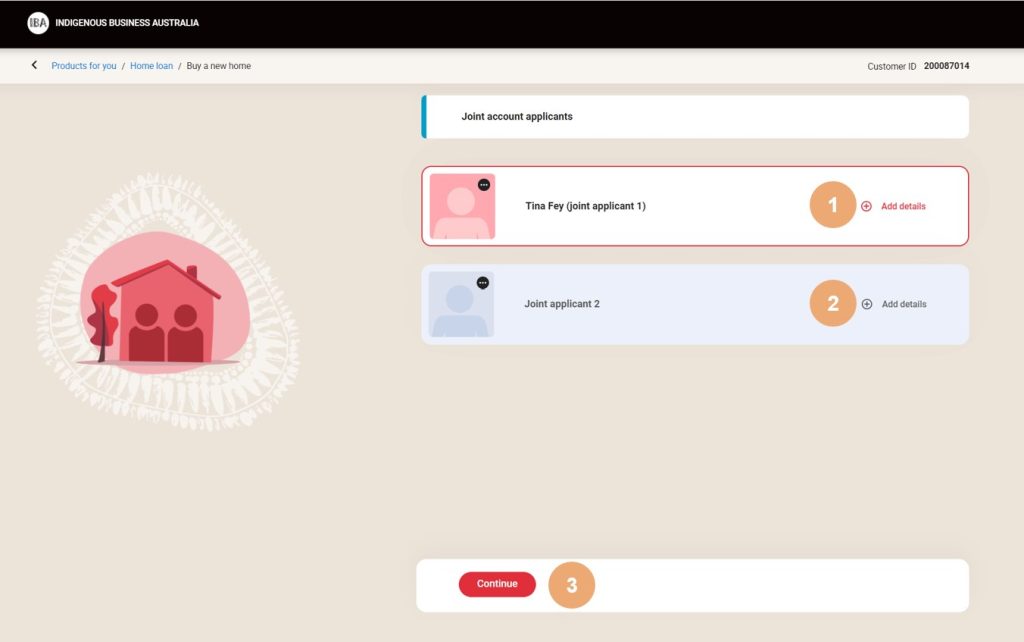

Applicants

Screen Name: Joint account applicants

Note: Up to 5 applicants can be added as part of a joint EOI

- Select to add details for joint applicant 1

- Option to add details for joint applicant 2 (only after details for joint applicant 1 are completed)

- Select Continue

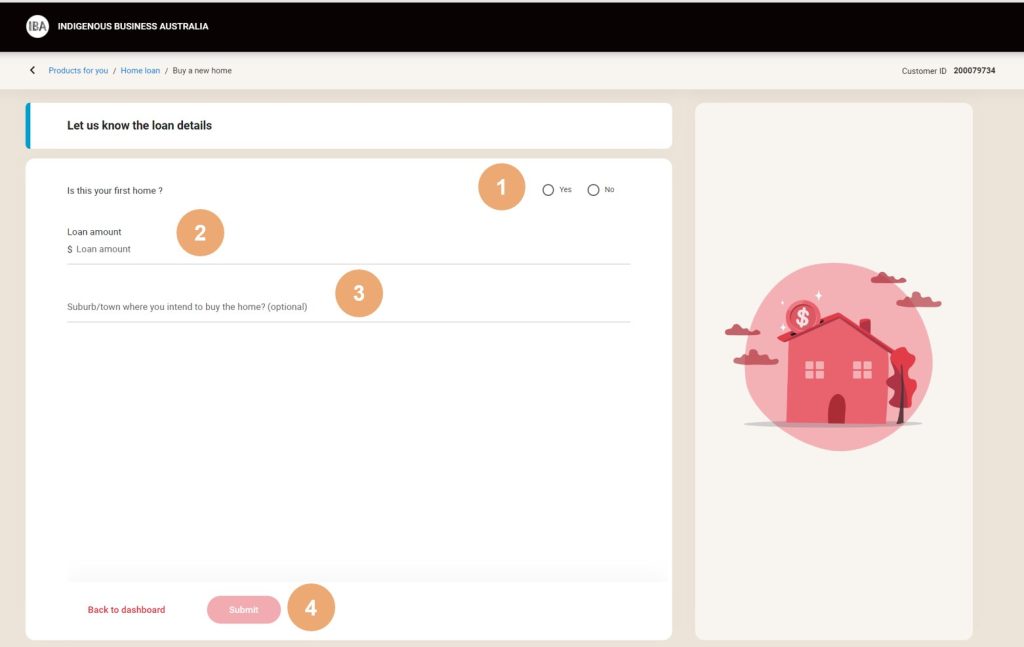

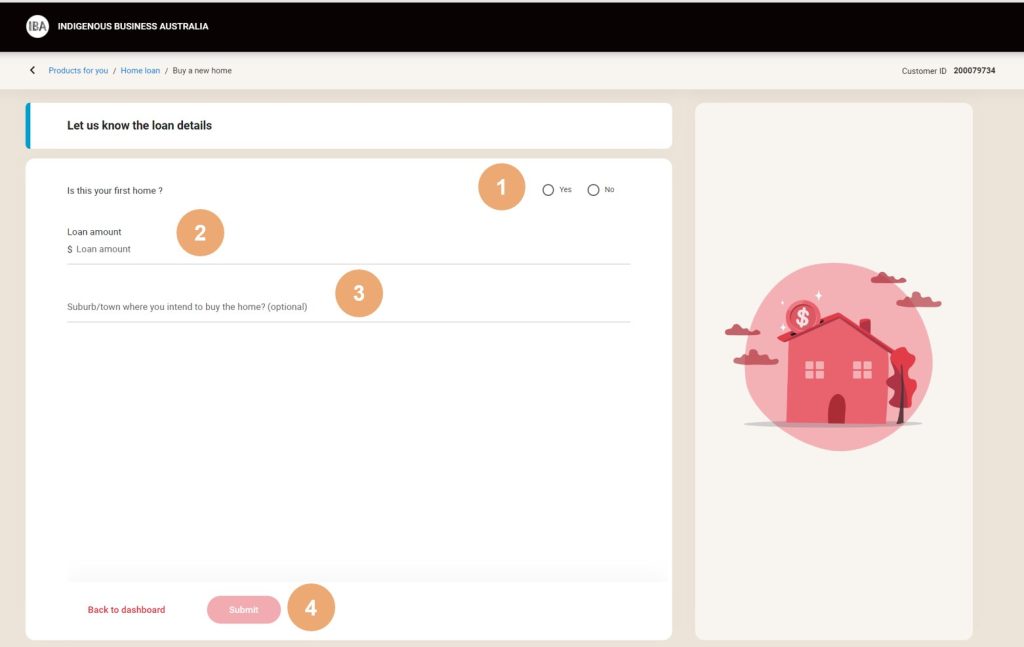

Loan Details

- Select either Yes/No to confirm a first home purchase

- Enter the Loan amount

- Enter the intended Suburb / town of purchase (Note - this is an optional field and not required to proceed)

- Select Submit

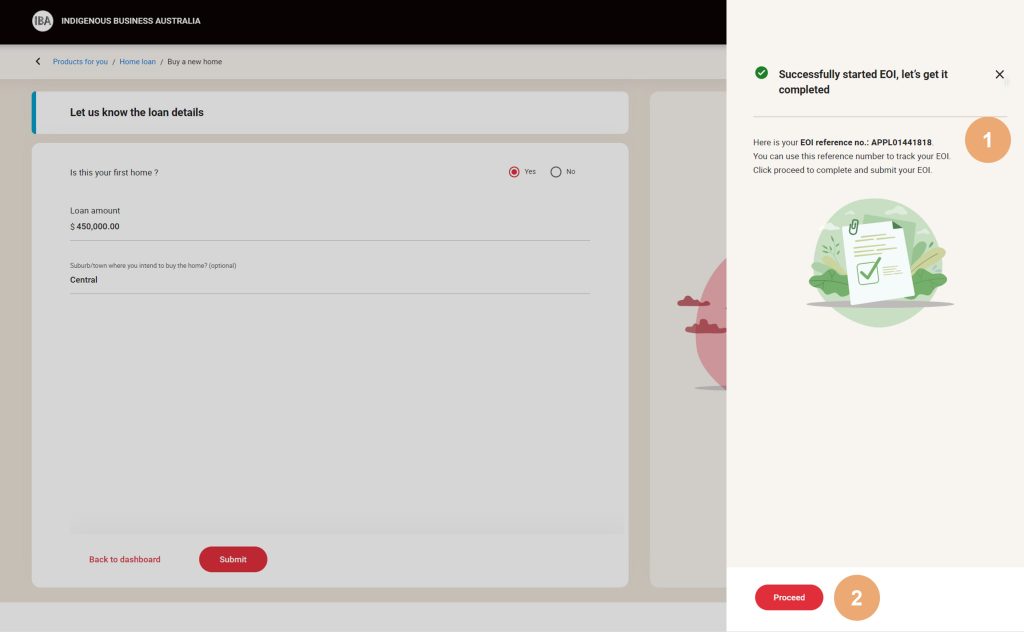

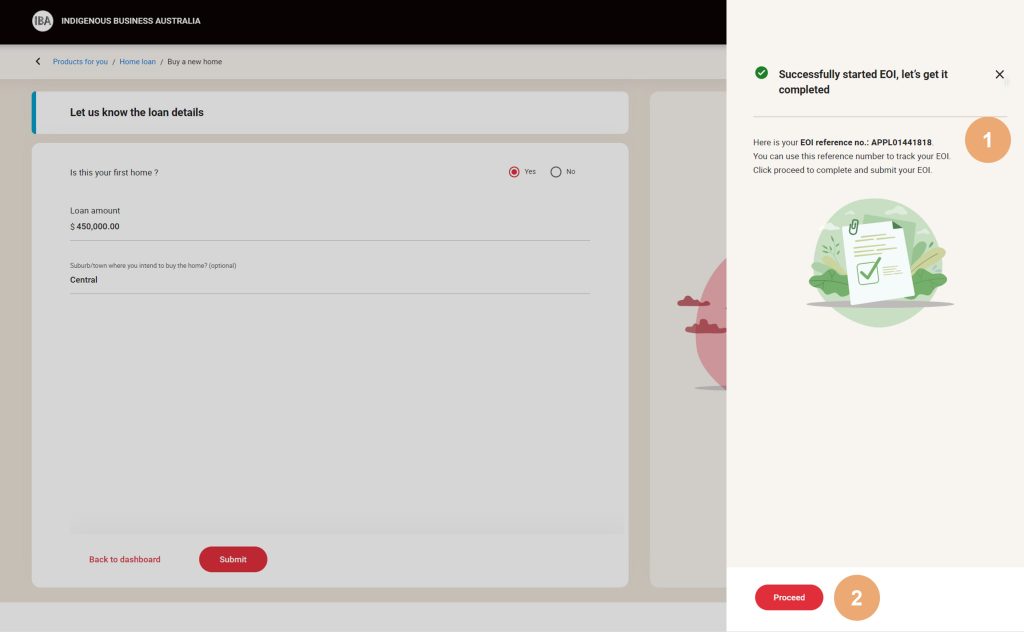

Application ID

Screen Name: Let us know the loan details

- An Application Number is generated and can be used to track the EOI status

- Select proceedImportant: The EOI will automatically lapse after 14 days from submission

Note: Once the application number is generated, a Joint EOI can only be submitted as a single EOI before adding a joint applicant

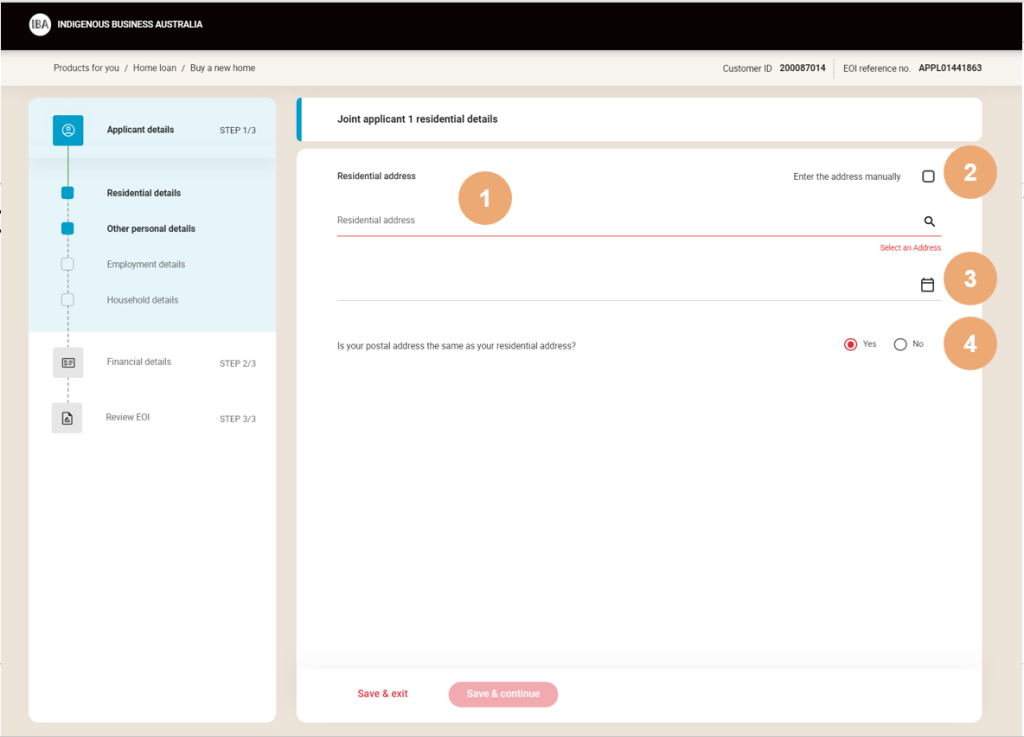

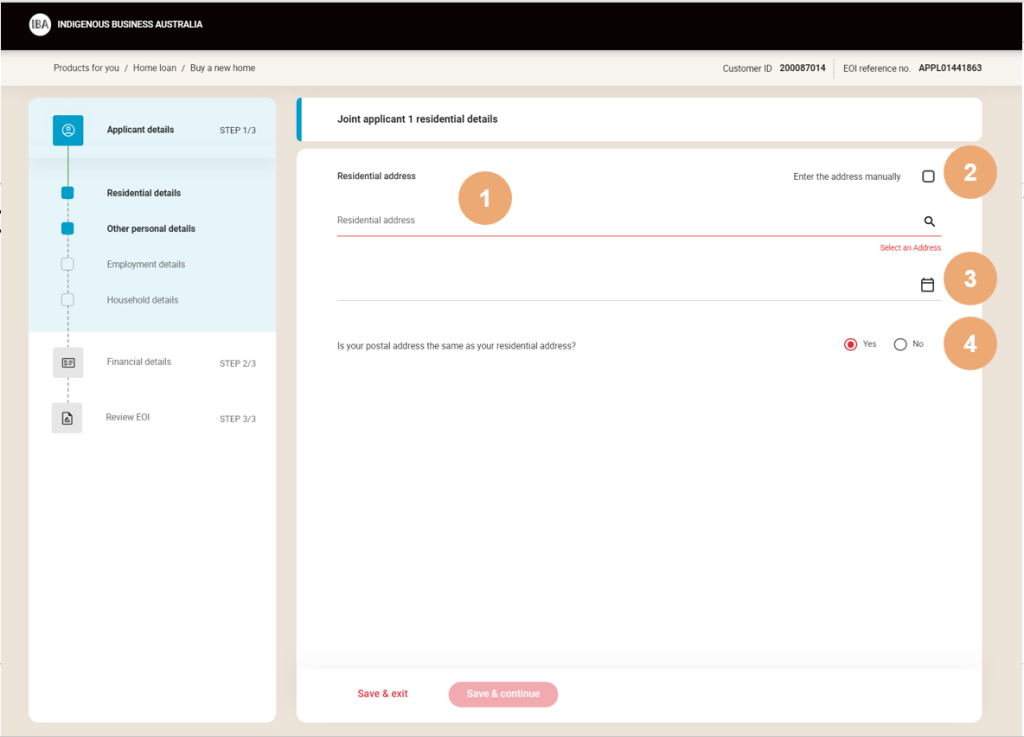

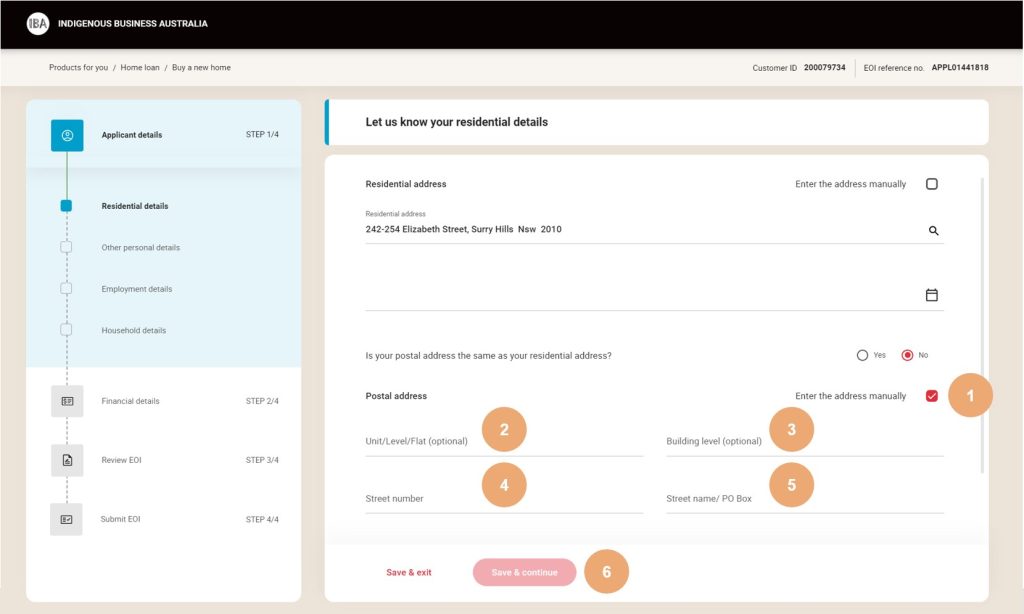

Residential Details

Screen Name: Joint applicant 1 residential details

- Enter the residential address to start an automatic search

- Use this option to manually search for the residential address using the information entered in the residential address field

- Select the calendar icon to select a move in date

- Select Yes if the postal address differs from the residential address

- If not, Select Save & continue

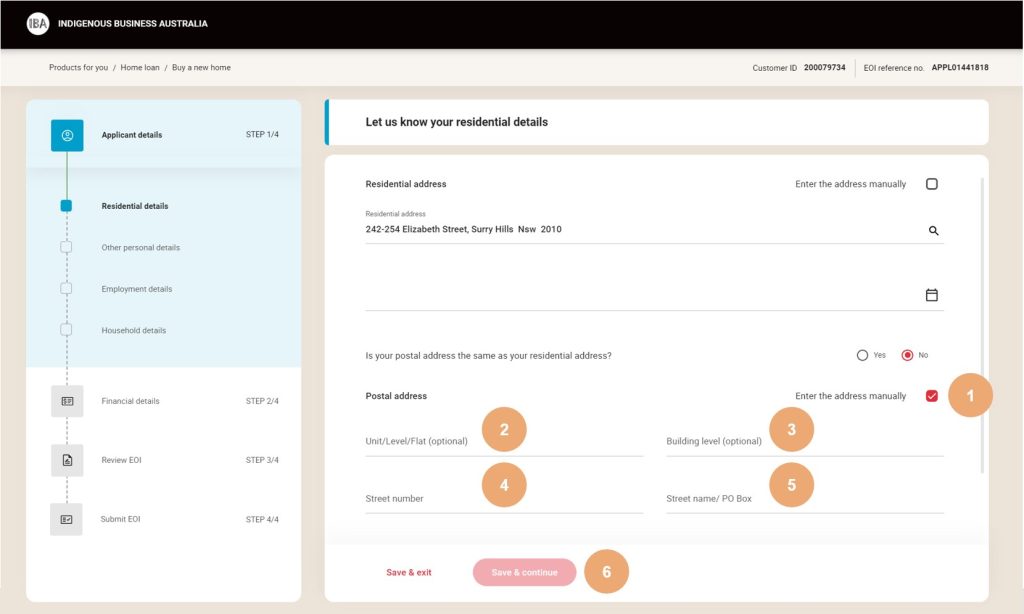

Different Postal Address

If the postal address differs from the residential address, either start entering the address to carry out an automatic search or manually add the details to populate the required fields

Manual Address Entry

- Enter the Unit/Level/Flat

- Enter the Building Level (optional)

- Enter the Street number

- Enter the Street name / PO Box

- Select Save and continue

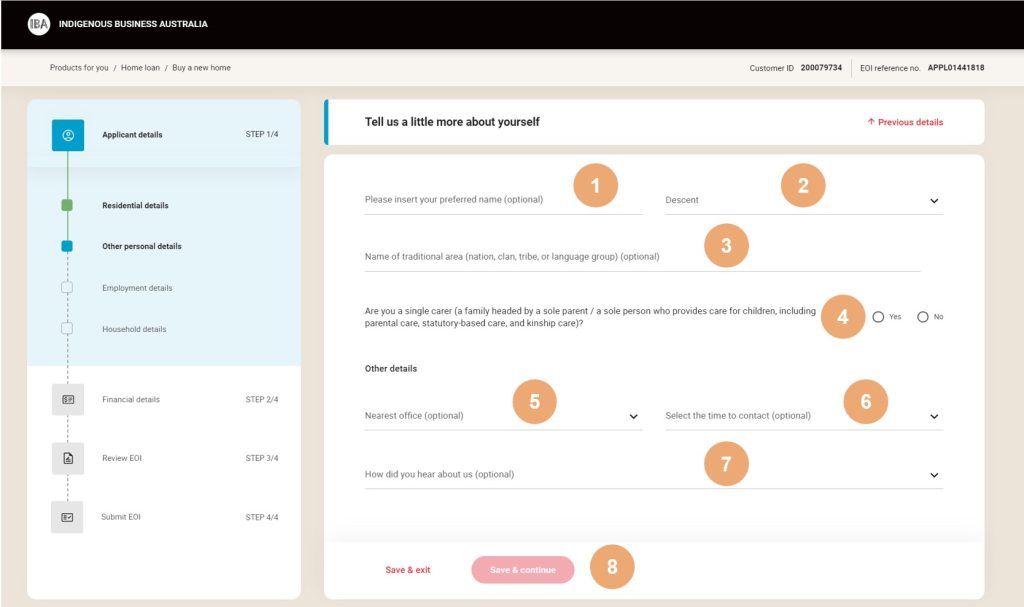

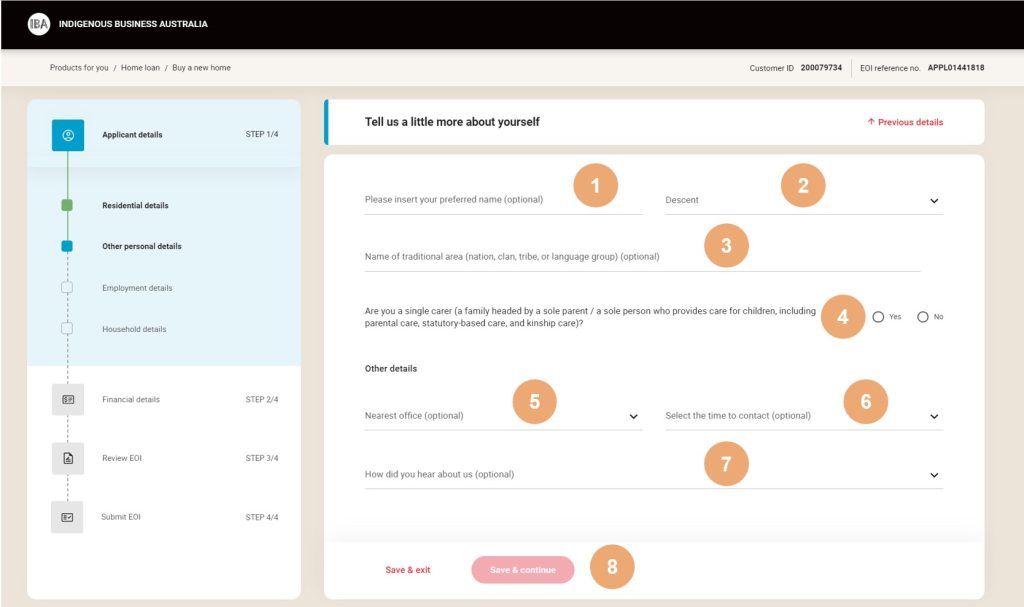

Other Personal Details

Screen Name: Joint applicant 1 other personal details

- Enter a preferred name (optional)

- Enter your Descent (you need to be of Aboriginal or Torres Strait Islander descent to qualify for a IBA Home Loan

- Enter the name of traditional area (nation, clan, tribe or language group) - (optional)

- Select Yes or No if a single carer

- Select 'the Nearest office' from the drop-down list (optional field)

- Select 'the time to contact' from the drop-down list

- Select 'How did you hear about us' from the drop-down list

- Select Save & continue

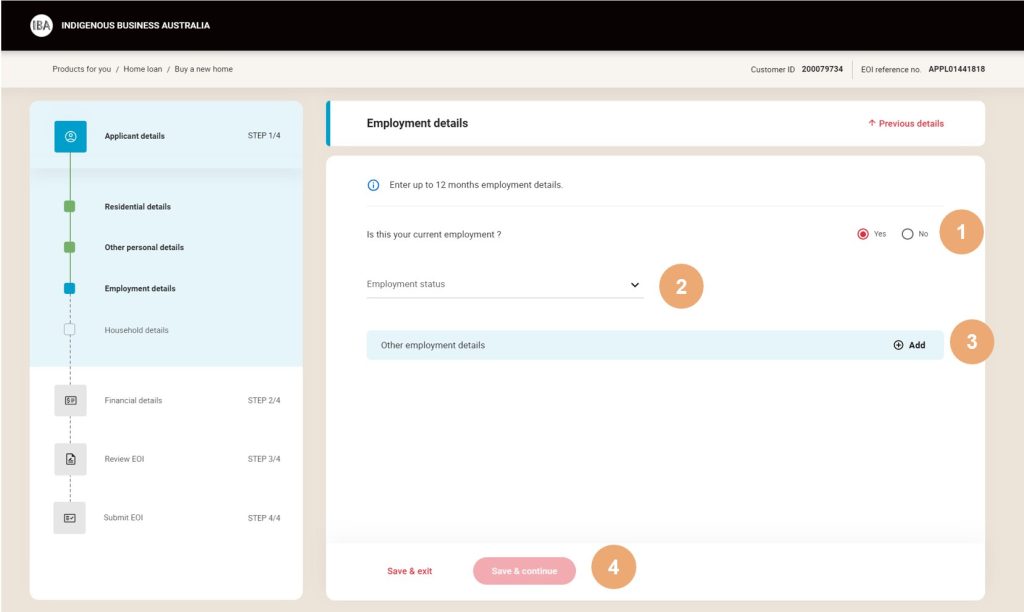

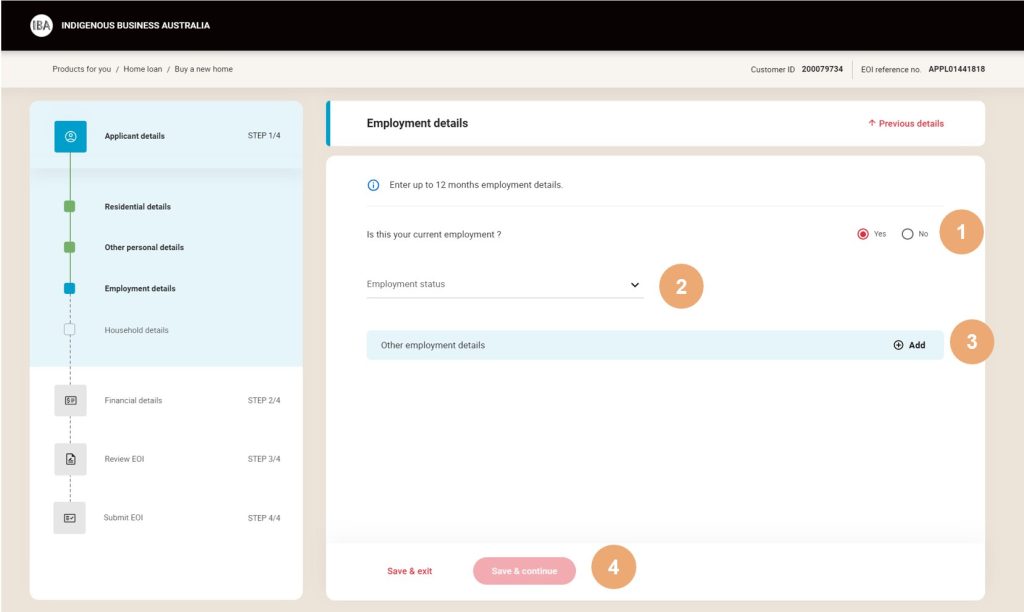

Employment details

Enter your employment details are entered in this section.

Screen Name: Joint applicant 1 employment details

- Select 'Yes or No' to confirm the current employment details are being entered

- Select the Employment status from the drop-down menu

- Select Add to enter other employment details

- Select Save & continue

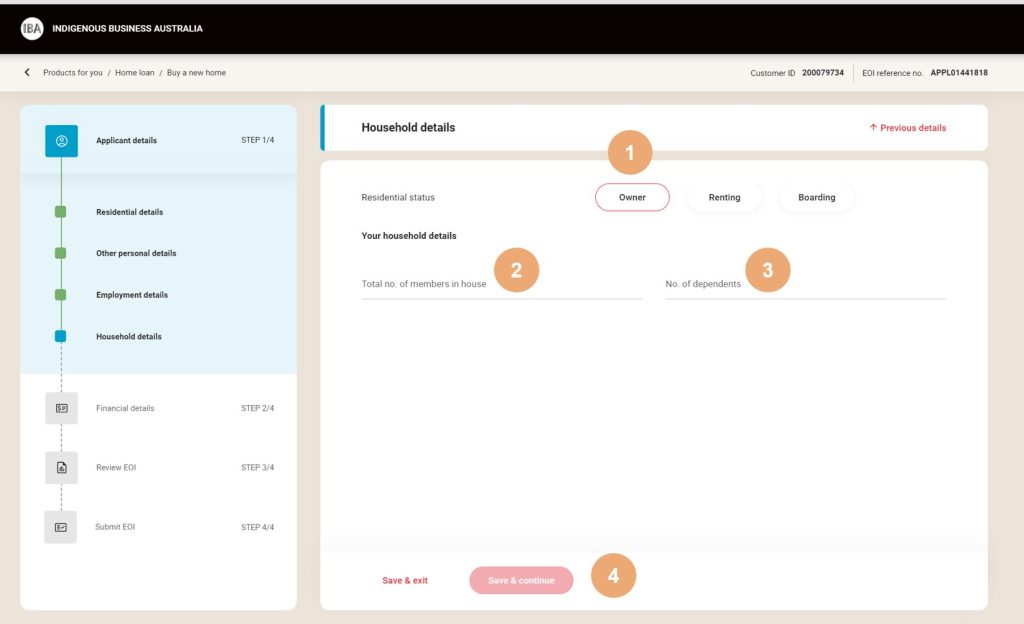

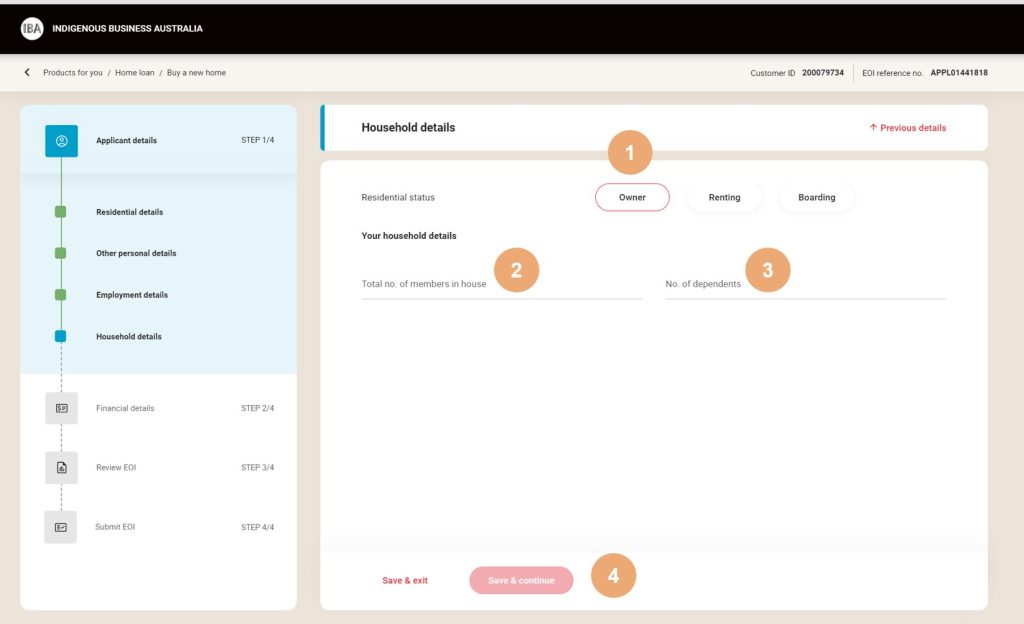

Household Details

Three options are available to determine the first Joint applicants' current residential status:

- Enter the Total no. of members in house

- No. of dependents

- Select Save & continue

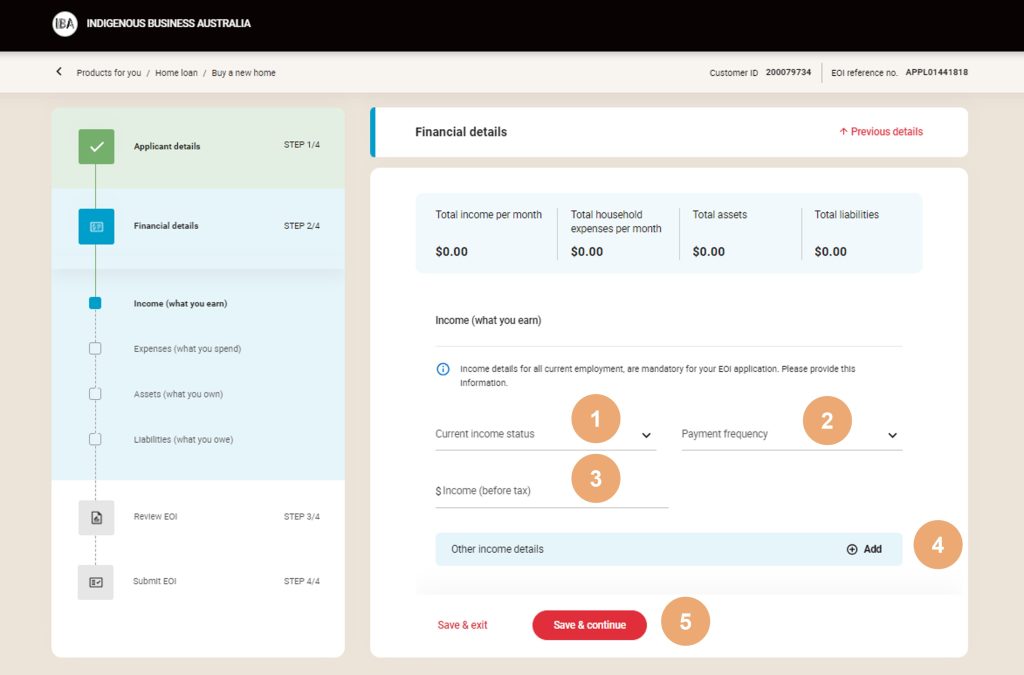

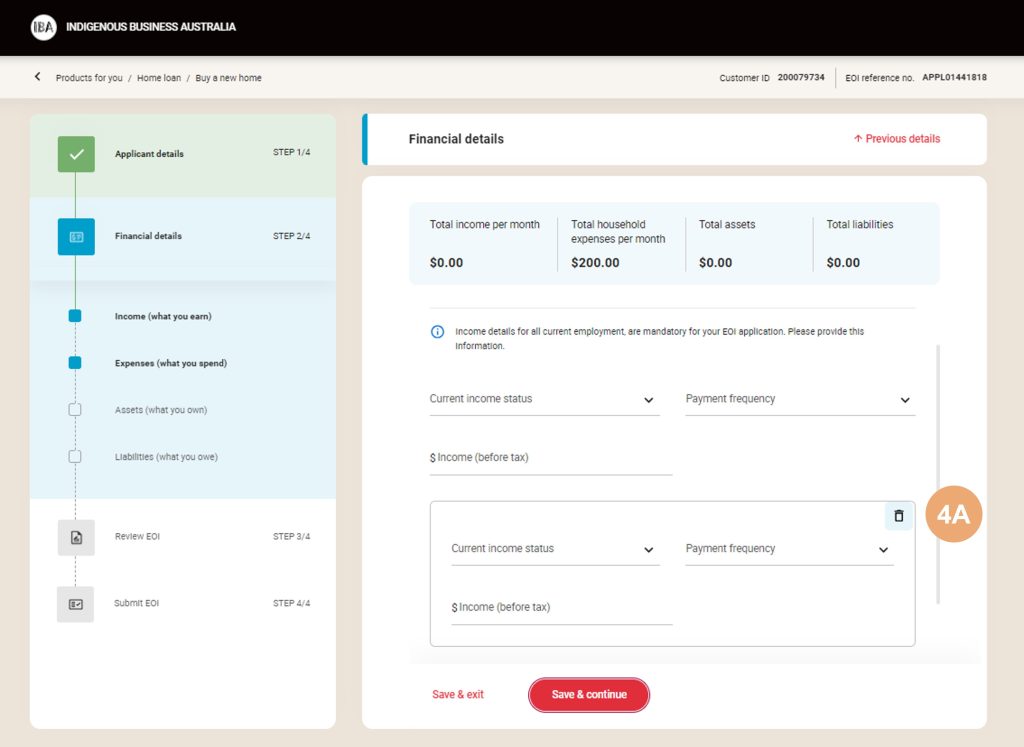

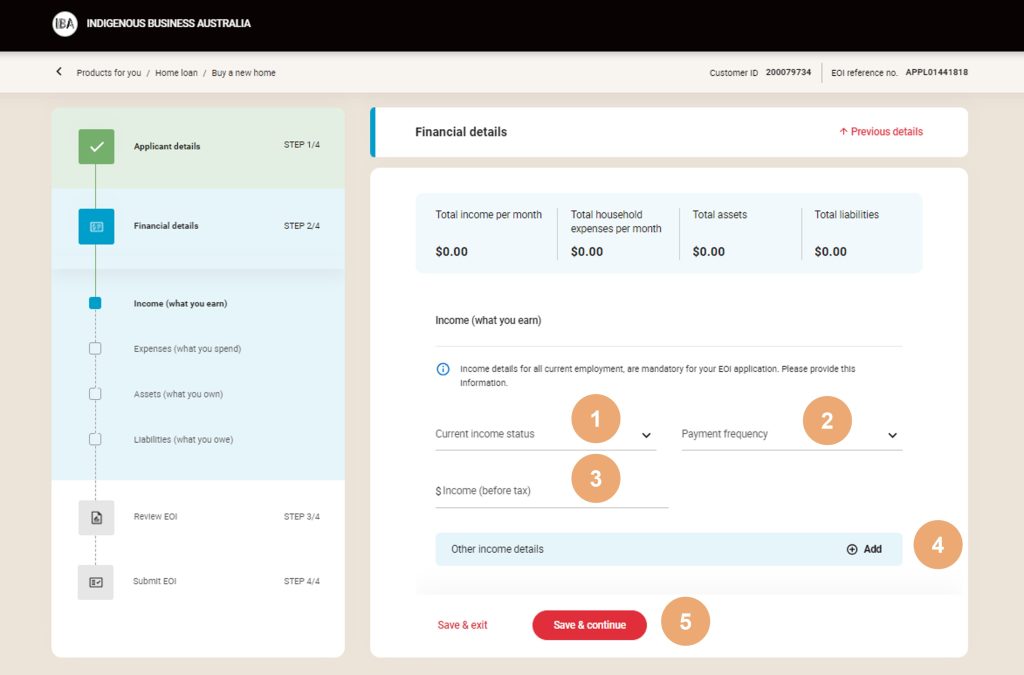

Financial Details

Screen Name: Joint applicant 1 financial details

- Select your current income status from the drop-down menu

- Select your payment frequency from the drop-down menu

- Enter your income (before tax)

- Use this option to enter other income details

- Select Save & continue

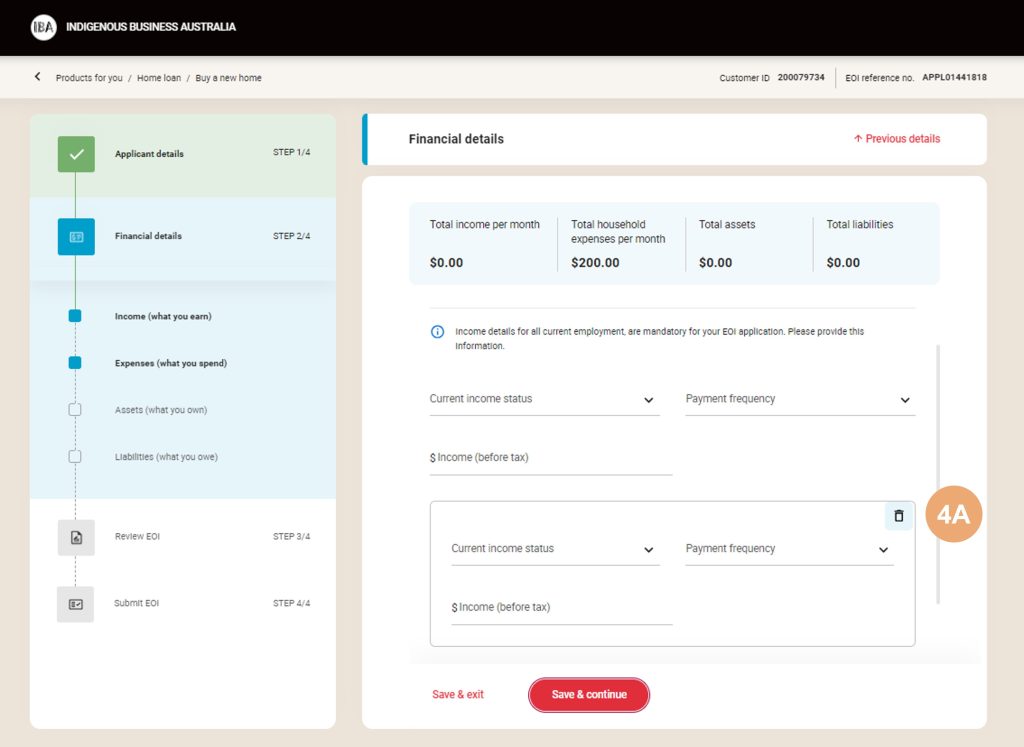

Other Income Details

Screen Name: Joint applicant 1 financial details

Use this option to add other current income details

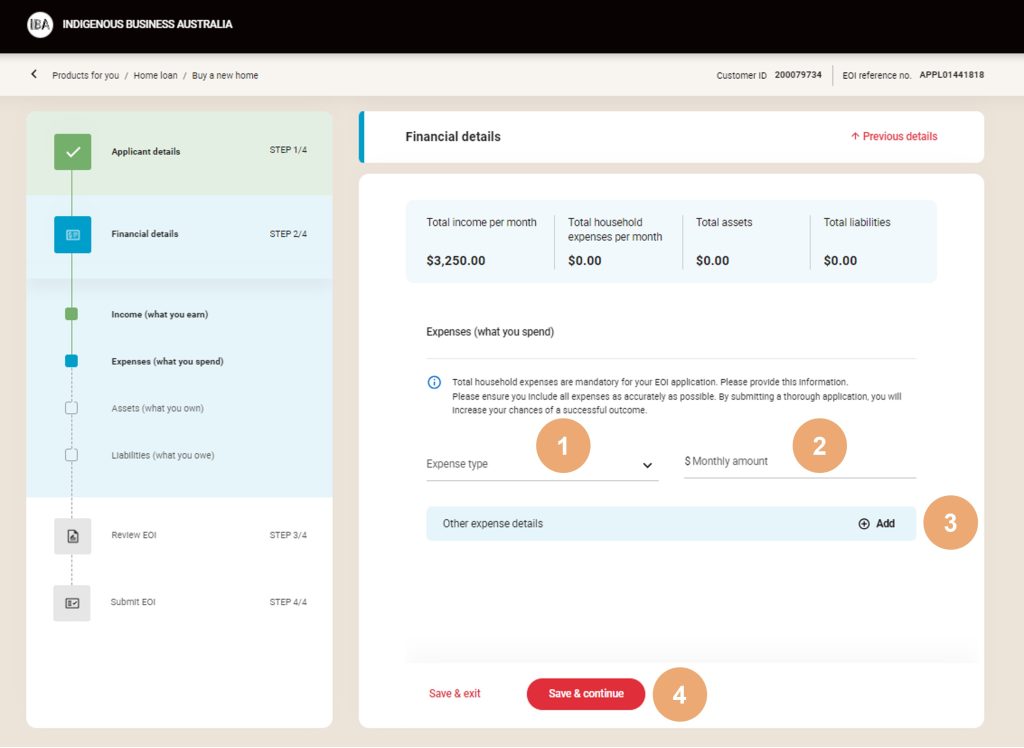

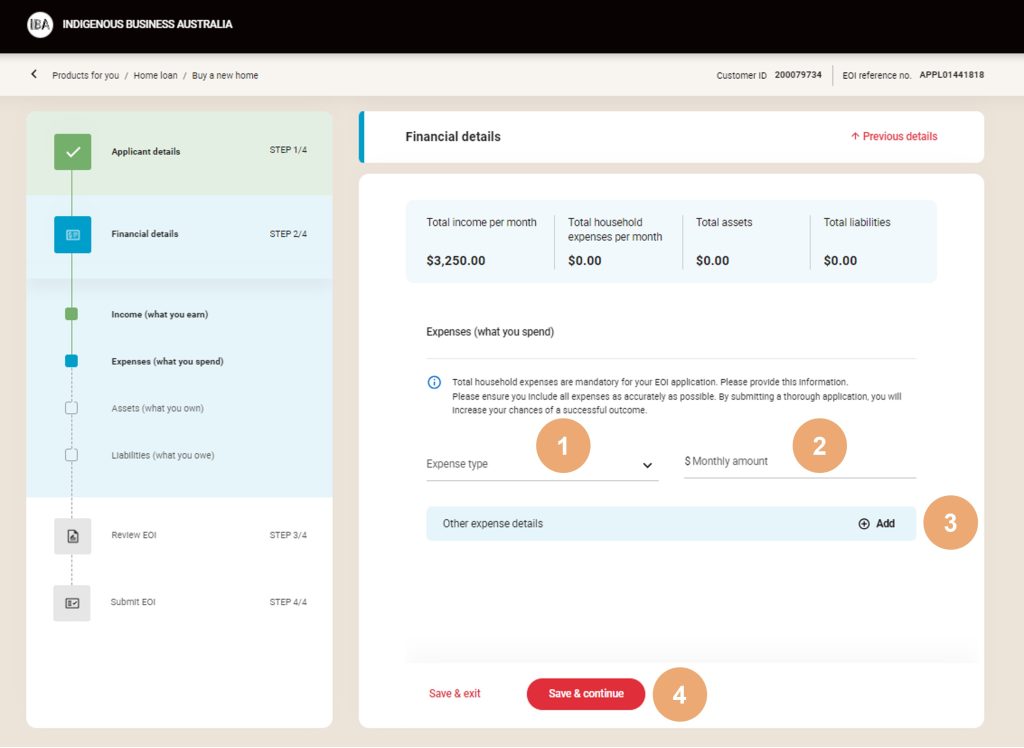

Expenses (what you spend)

Screen Name: Joint applicant 1 financial details

Use this section to add your actual monthly expenses

- Select the expense type from the drop-down menu

- Enter the monthly amount

- Select +Add to include other expense details

- Select Save & continue

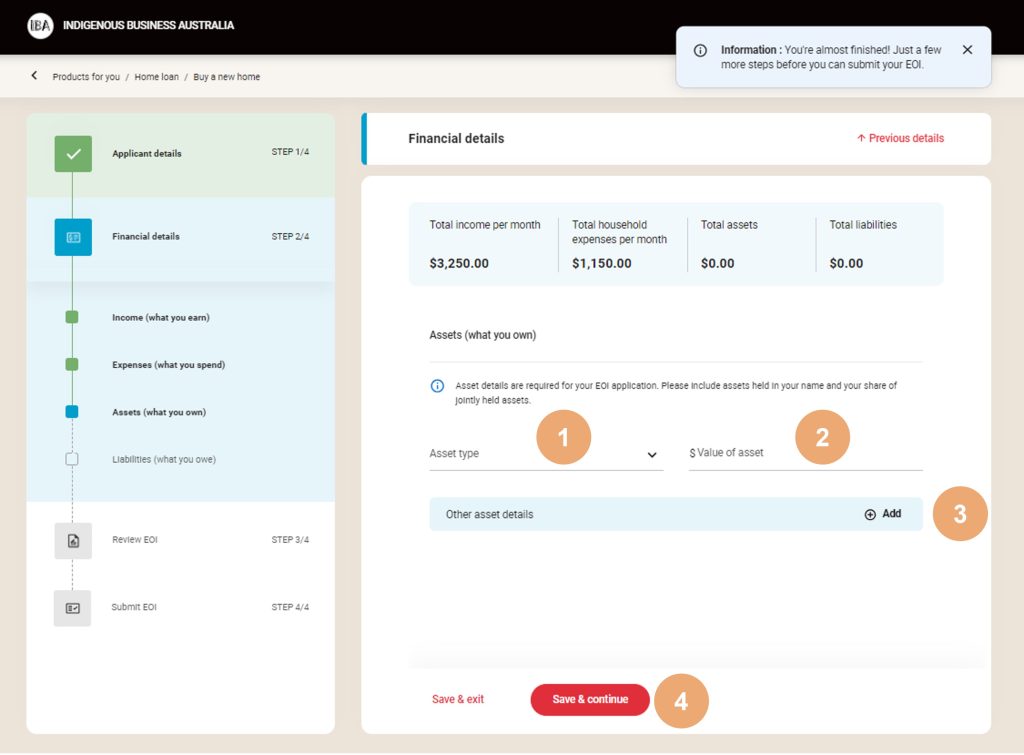

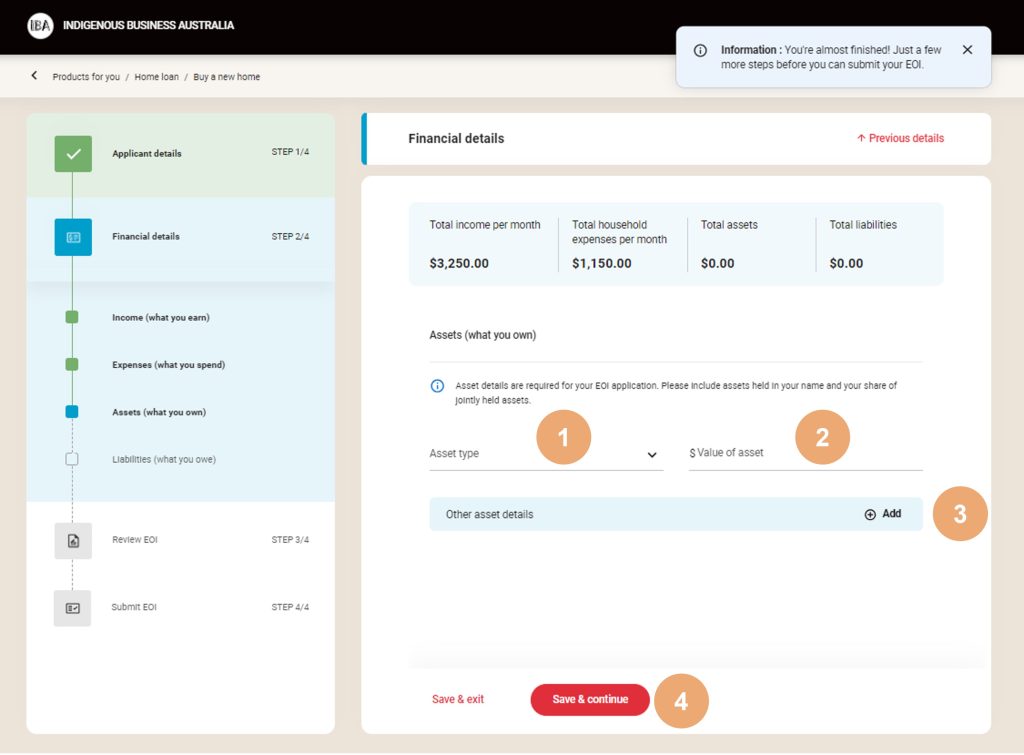

Assets (what you own)

Use this section to list your owned assets

- Select the Asset type from the drop-down menu

- Enter the Value of asset

- Select Add to include more asset details

- Select Save & continue

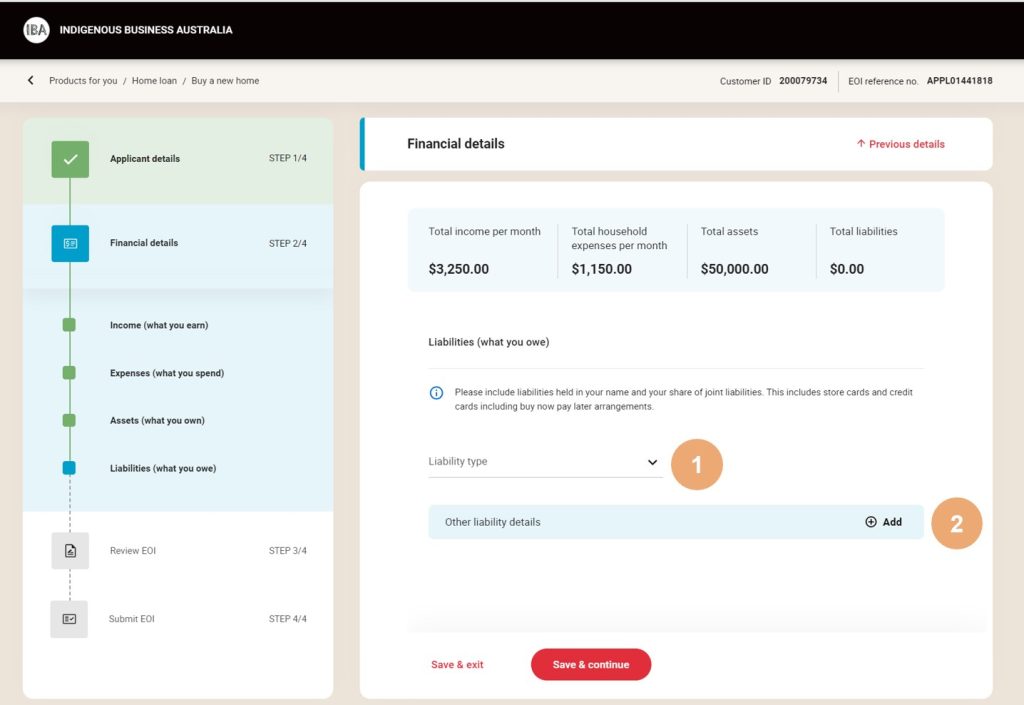

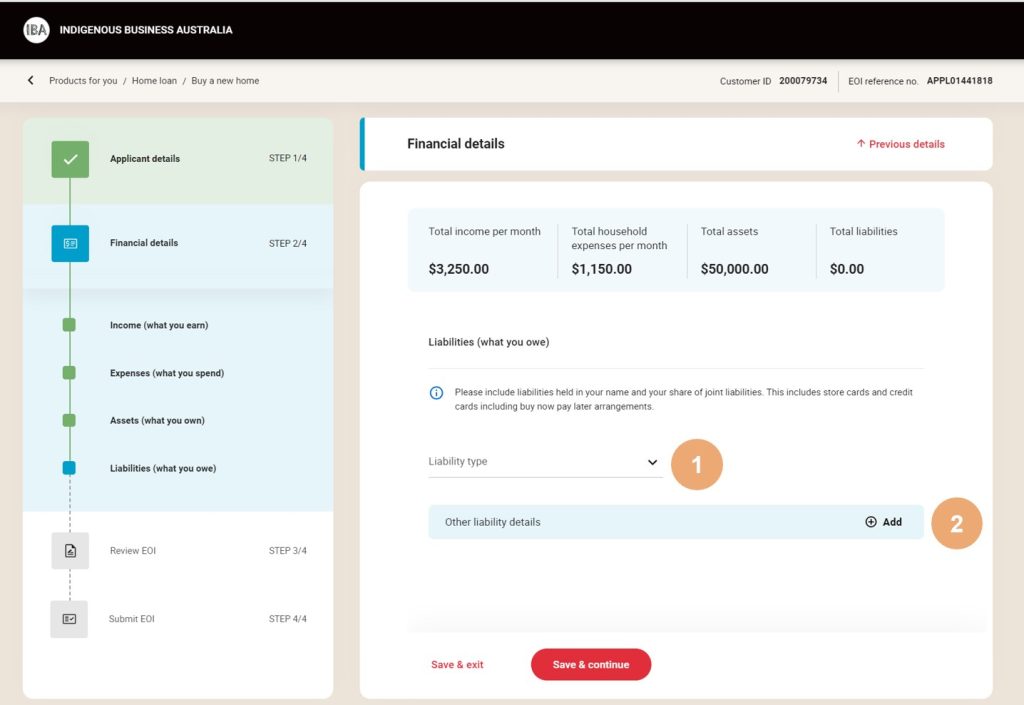

Liabilities (what you owe)

Screen Name: Financial Details

List the liabilities held in your name and your share of joint liabilities. This also includes store cards and credit cards including buy now pay later arrangements.

- Select the Liability type from the drop-down menu

- Select +Add to enter other liability details

- Select loan type

- Enter the loan repayment amount based on the frequency selected

- Enter the lender name (optional)

- Enter the amount owning

- Select the frequency from the drop-down menu

- Select Save & continue

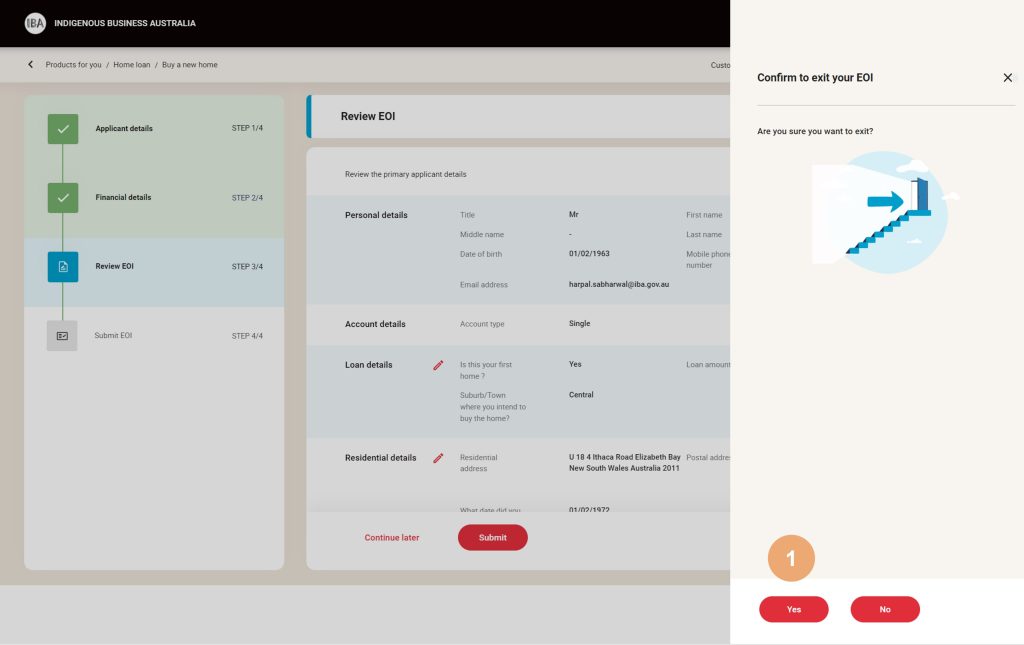

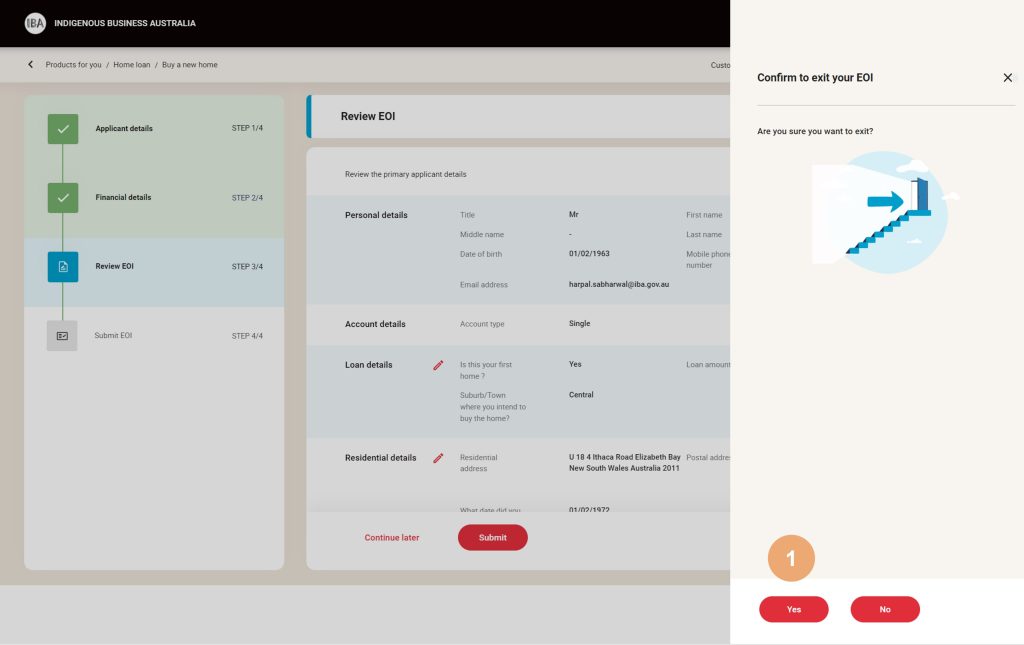

Review EOI

Screen Name: Joint applicant 1 review EOI

Scroll to review completed sections using the pen symbol to edit each individual area

- Select pen symbol to edit a section if required

- Select to continue later

- Select to submit

Continue Later

1. Select Yes to exit

From the application dashboard, choose one or more of the following options

- Logout

- Resume EOI

- Update Profile & Settings

- Upload Profile Picture

The EOI remains active for up to 14 days before deleted.

Add second applicant

Screen Name: Joint account applicants

- Select to add Joint applicant 2 details

- Select Save & continue

Continue with above steps for joint applicant 2.

Submit EOI

- Click to download a PDF copy of the EOI

- Select to Close the window